By earning supplemental principal payments higher than Whatever you owe in your mortgage payment help you build fairness right away too. The quantity of equity you might have can fluctuate depending on alterations in the home’s marketplace benefit.

Check out our several selections for 2nd mortgages and lock into a hard and fast interest mortgage even though rates are so reasonably priced.

For those who default to the payments of your respective personal loan you might be accountable for supplemental fees. At 95 loans we strive to work with lenders that use reasonable and authorized selection actions to rectify a financial loan that has not been repaid.

Make robust offers on households with a confirmed pre-approval letter. A loan officer will evaluate the paperwork you've got well prepared and verify the amount you might be permitted for.

HELOCs can be very handy for financing significant assignments, for instance renovating your house. Don't forget, it’s super imperative that you thoroughly approach and have an understanding of your borrowing options prior to deciding to go with this economic merchandise.

When you don’t have more than enough fairness to qualify for a standard dwelling fairness loan, you could possibly take into consideration other available choices:

Most lenders choose that homeowners have no less than fifteen% to twenty% fairness in their houses to qualify for a home fairness personal loan. This means that following accounting for your loan, your loan-to-benefit (LTV) ratio should really ideally be 80% or reduced. In case you have below 20% fairness, it should still be attainable to obtain a HELOC or set 2nd-mortgage loan, but lenders might impose stricter terms, such as greater desire premiums or decrease borrowing limits.

Will you be considering tapping into your own home’s fairness to repay personal debt or go over A serious expenditure? Taking income out isn’t your only solution. A house fairness line of credit, or HELOC, offers you versatility to entry a large sum, but only get dollars out as you need it. You only have to create payments on the amount you’ve truly borrowed, which can help keep the payments and fascination decrease.

Neighborhood banking institutions are typically more info much easier to get the job done with due to the fact they typically don’t have membership specifications, rendering it simpler to apply for a ninety five% LTV HELOC without any extra hoops to jump as a result of.

As it’s a revolving source of funds that has a credit score Restrict, a HELOC behaves a good deal similar to a quite reduced desire credit card. The speed is substantially lower than regular credit cards or own loans since it is secured by your home.

Furthermore, house loan curiosity about the refinanced portion might be tax-deductible if used for house advancements. Consult with a tax professional for unique deductions.

This financial loan is for Individuals who have ample equity in their dwelling, that just after their new 2nd house loan they nevertheless have at the very least five% fairness left of their residence (cltv).

Assessment your credit rating and revenue — and stay clear of getting out loans, opening credit cards or building massive purchases for six months.

Together with house loan fascination costs, Just about every lender has service fees and shutting expenditures that variable into the general price of the home mortgage. When picking a lender, compare Formal Personal loan Estimates from at least a few distinctive lenders and specifically listen to that have the lowest price and least expensive APR. This will help you feel self-assured you will be obtaining the very best offer.

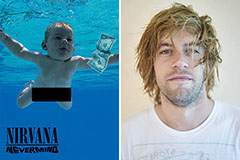

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!